Using Divergence in Trading Strategies: Unlocking Profit Potential

Using Divergence in Trading Strategies

Introduction

Divergence is a powerful concept in trading that can provide valuable insights into potential market reversals. It is a technical analysis tool that compares price movements with indicators to identify discrepancies, indicating a possible change in trend direction. By understanding and utilizing divergence in trading strategies, traders can enhance their decision-making process and potentially increase their profitability.

What is Divergence?

Divergence occurs when the price of an asset moves in the opposite direction of a technical indicator. It indicates a potential shift in market sentiment and can be observed on various indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator. Divergence can be classified into two types: bullish and bearish.

Bullish Divergence

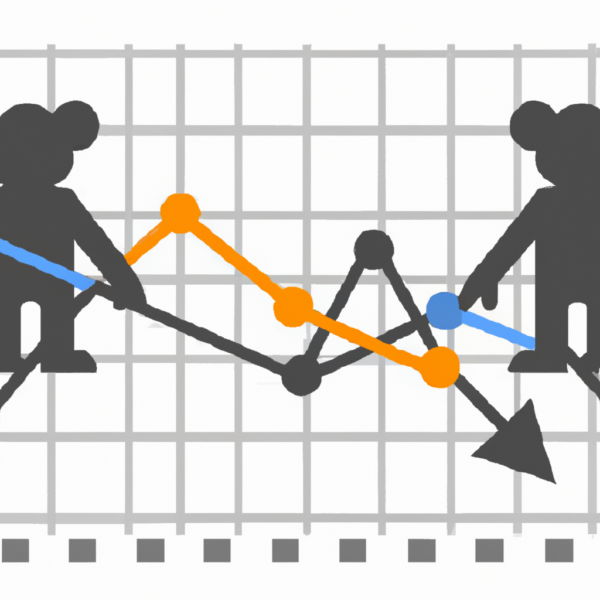

Bullish divergence occurs when the price of an asset forms a lower low while the indicator forms a higher low. This suggests that despite the downward movement in price, the momentum is weakening, and a potential upward reversal may be imminent. Traders often interpret bullish divergence as a signal to consider buying or entering long positions.

Bearish Divergence

On the other hand, bearish divergence occurs when the price of an asset forms a higher high while the indicator forms a lower high. This indicates that despite the upward movement in price, the momentum is decreasing, and a potential downward reversal may be on the horizon. Traders often interpret bearish divergence as a signal to consider selling or entering short positions.

Using Divergence in Trading Strategies

Divergence can be a valuable tool in developing trading strategies. Here are a few ways to incorporate divergence into your trading approach:

1. Confirming Reversal Signals

Divergence can act as a confirmation tool for other technical analysis indicators or patterns. For example, if a trader identifies a bullish divergence while observing a double bottom formation, it strengthens the likelihood of an upcoming price reversal. By combining multiple signals, traders can increase the probability of successful trades.

2. Identifying Overbought or Oversold Conditions

Divergence can also help identify overbought or oversold conditions in the market. When an asset’s price reaches new highs, but the indicator fails to follow suit, it suggests that the market may be overextended. Conversely, when an asset’s price reaches new lows, but the indicator fails to confirm, it indicates potential oversold conditions. Traders can use this information to anticipate corrective price movements.

3. Setting Stop Loss and Take Profit Levels

Divergence can assist traders in establishing appropriate stop loss and take profit levels. By considering the presence of divergence, traders can set their stop loss orders closer to the entry point, reducing potential losses if the anticipated reversal fails to materialize. Similarly, take profit levels can be adjusted based on the strength of divergence, allowing traders to capture more significant profits when divergence signals align with other technical indicators.

Conclusion

Divergence is a valuable tool in trading that can help traders identify potential reversals, confirm signals, and manage risk. By understanding and incorporating divergence into their trading strategies, traders can enhance their decision-making process and potentially increase their profitability. However, it is essential to remember that divergence is not a foolproof indicator and should be used in conjunction with other technical analysis tools for a comprehensive trading approach.