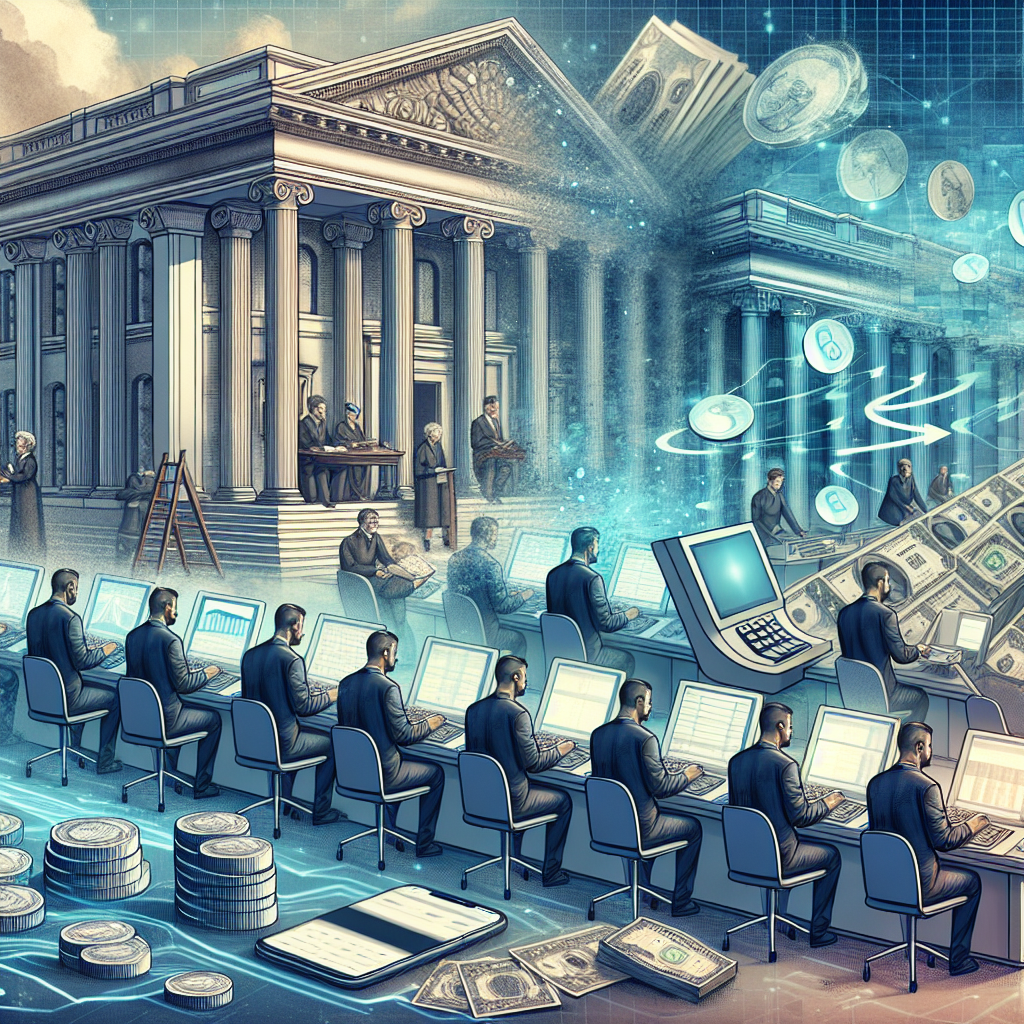

Banking Sector Digital Transformation: A Guide to Navigating the Future of Finance

In the rapidly evolving world of finance, digital transformation has become a prevalent force reshaping the contours of the banking sector. Banks worldwide are embracing technological innovations to enhance customer experience, streamline operations, and foster financial inclusivity. This comprehensive guide delves into the various aspects of digital transformation in banking, offering insights into the strategies, technologies, and benefits that herald the dawn of a new era in financial services.

The Imperative for Digital Transformation in Banking

The shift towards digitalization in banking is driven by a combination of factors including changing consumer expectations, increased competition from fintech startups, regulatory pressures, and the undeniable benefits of technological adoption in terms of cost and efficiency. Digital transformation affords banks the opportunity not only to modernize their services but also to innovate in creating new business models and revenue streams.

Key Technologies Driving Digital Transformation

Artificial Intelligence and Machine Learning

AI and ML are at the forefront of the banking digital revolution, enabling personalized banking experiences, predictive analytics for credit scoring, and automation of routine tasks. This not only enhances customer satisfaction but also significantly reduces operational costs.

Blockchain Technology

Blockchain offers a secure and transparent framework for transactions, reducing fraud and improving the efficiency of payment systems. Its adoption is revolutionizing aspects such as cross-border payments and identity verification.

Cloud Computing

The adoption of cloud services enables banks to scale operations flexibly, improve resilience, and innovate rapidly by deploying new applications and services at speed, all while ensuring data security and compliance.

Strategies for Successful Digital Transformation

Aligning Digital Strategy with Business Objectives

It’s crucial for banks to align their digital transformation initiatives with overarching business goals. This alignment ensures that digital efforts contribute meaningfully to customer satisfaction, operational efficiency, and business growth.

Fostering a Culture of Innovation

Creating a culture that encourages innovation is essential for digital transformation success. Banks need to promote an environment where employees feel empowered to experiment, learn from failures, and contribute ideas.

Partnerships with Fintech Companies

Collaboration with fintech companies can accelerate digital initiatives, providing banks with access to cutting-edge technologies and innovative business models that can complement their existing offerings.

Challenges and Considerations

Digital transformation is not without its hurdles. Regulatory compliance, cybersecurity threats, and the need for significant investment in technology and skills present challenges that banks must navigate. Moreover, managing the cultural shift towards digital-first thinking requires careful planning and execution.

Measuring Success

Customer Satisfaction

Enhanced customer experience is a key indicator of successful digital transformation. Metrics such as Net Promoter Score (NPS) can provide insights into customer satisfaction and loyalty.

Operational Efficiency

Improvements in operational efficiency, as evidenced by reduced costs and faster service delivery times, are critical measures of the effectiveness of digital initiatives.

Innovation and Market Share

The ability to innovate and capture a larger share of the market is also indicative of successful digital transformation. This includes the launch of new digital products and services that meet the evolving needs of customers.

Conclusion

The journey of digital transformation in the banking sector is both challenging and exhilarating. By embracing cutting-edge technologies, aligning digital strategies with business objectives, and fostering a culture of innovation, banks can navigate the complexities of the digital age to emerge as leaders in the future of finance. The successful execution of these strategies will not only redefine customer experiences but also set new standards for operational efficiency and financial inclusivity in the global banking industry.