Resistance Breakout Strategies: A Guide to Trading Success

Introduction

Resistance breakout strategies are a popular approach in technical analysis used by traders to identify potential trading opportunities. These strategies aim to capitalize on the price movement of an asset when it breaks above a resistance level, indicating a potential upward trend. In this article, we will explore the key concepts and steps involved in implementing resistance breakout strategies effectively.

Understanding Resistance Levels

Resistance levels are price levels at which an asset tends to encounter selling pressure, preventing it from rising further. These levels are formed when the price repeatedly fails to break above a certain threshold, creating a psychological barrier for traders. Identifying and understanding resistance levels is crucial in resistance breakout strategies.

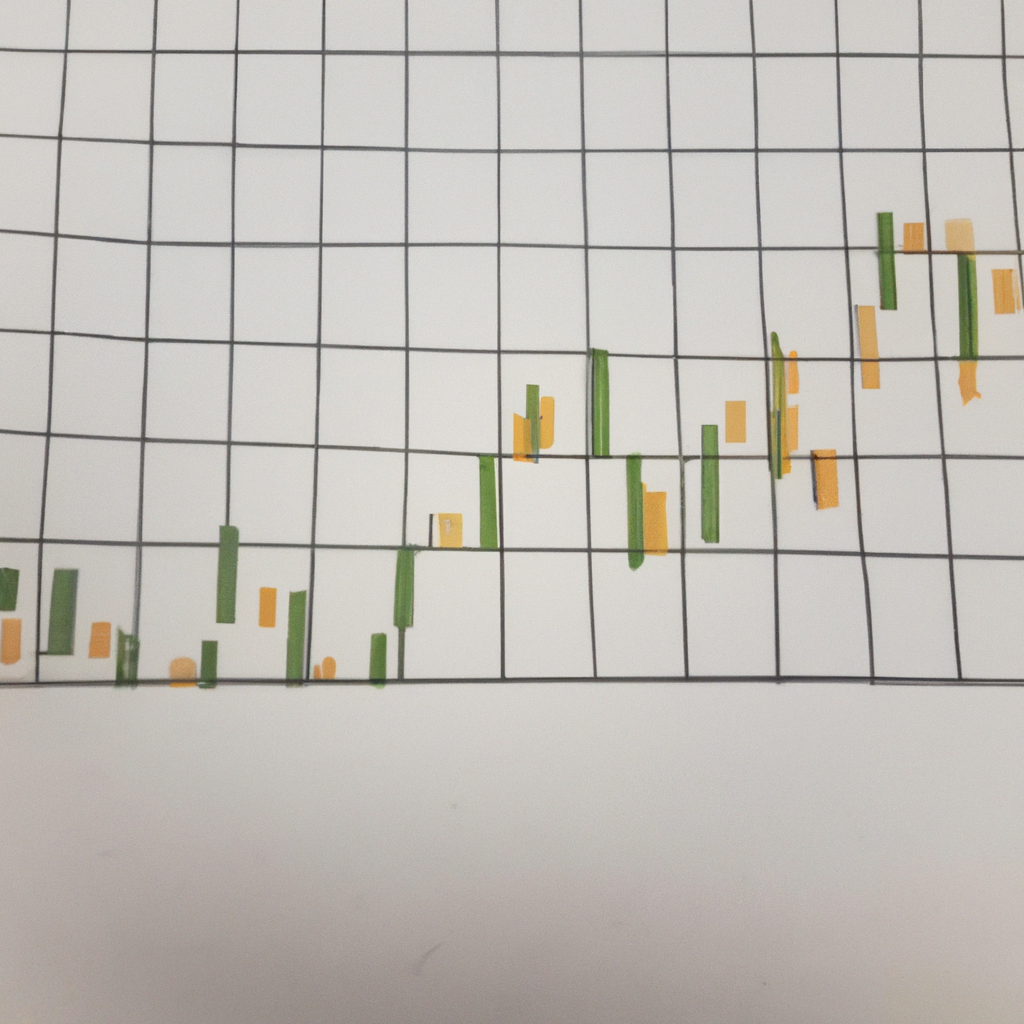

Identifying Potential Breakouts

Before executing a resistance breakout strategy, it is essential to identify potential breakout candidates. Traders typically look for assets that have been consolidating near a resistance level for an extended period. This consolidation phase indicates a battle between buyers and sellers, with a breakout likely to occur once the buying pressure overwhelms the selling pressure.

Confirming Breakouts

Confirming a breakout is crucial to avoid false signals and minimize risk. Traders often wait for the price to close above the resistance level on a significant timeframe, such as the daily or weekly chart. This confirmation helps ensure that the breakout is genuine and not a temporary spike or false breakout.

Setting Entry and Exit Points

Once a breakout is confirmed, traders need to determine their entry and exit points to manage their trades effectively. Some traders choose to enter the trade immediately after the breakout, while others prefer to wait for a pullback to the breakout level, using it as a support-turned-resistance area.

Setting a stop-loss order is vital to limit potential losses in case the breakout fails. Traders often place their stop-loss orders slightly below the breakout level to protect their capital. Additionally, establishing a target price or using trailing stops can help secure profits as the price continues to rise.

Risk Management and Position Sizing

Implementing proper risk management techniques is crucial in resistance breakout strategies. Traders should determine their risk tolerance and set appropriate position sizes accordingly. It is generally advisable not to risk more than a certain percentage of your trading capital on a single trade.

Monitoring and Adjusting Strategies

Resistance breakout strategies require continuous monitoring and adjustment. Traders should regularly review their trades, analyze the effectiveness of their strategies, and make necessary adjustments based on market conditions and performance.

It is crucial to keep learning and adapting to the ever-changing market dynamics to stay ahead in the trading game. Experimenting with different variations of resistance breakout strategies and incorporating additional technical indicators can further enhance the effectiveness of your trading approach.

Conclusion

Resistance breakout strategies provide traders with a systematic approach to capitalize on potential upward price movements. By understanding resistance levels, identifying breakouts, and implementing proper risk management techniques, traders can increase their chances of success. Remember, consistency and continuous learning are key to mastering resistance breakout strategies and achieving trading success.