Using Moving Averages for Trend Analysis

Moving averages are a cornerstone of financial analysis, offering insights into market trends and helping traders and analysts predict future movements. This tool smooths price data to create a single flowing line, making it easier to identify the direction of a trend, be it an upward, downward, or sideways market. This article explores the fundamentals of using moving averages for trend analysis, covering different types, how to calculate them, and strategies for utilizing them effectively.

Understanding Moving Averages

Moving averages are calculated by averaging a set number of time periods together and then moving forward in time by updating the average to include the newest period. This process helps in smoothing out short-term fluctuations and highlighting longer-term trends or cycles.

Types of Moving Averages

There are several types of moving averages, each with its unique calculation and application. The two most common are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- Simple Moving Average (SMA): Calculates the average price over a specific number of periods. It gives equal weight to all points.

- Exponential Moving Average (EMA): Also averages prices over a set period but gives more weight to recent prices, making it more sensitive to new information.

Calculating Moving Averages

Calculating moving averages is straightforward, especially with the aid of spreadsheet software or trading platforms that typically include tools to simplify this process.

Steps for Calculating SMA

- Select the period (e.g., 20 days, 50 days, 200 days).

- Add up the closing prices of the stock for all the days included in the period.

- Divide the total by the number of days (period).

Steps for Calculating EMA

The calculation for EMA is more complex because it includes a weighting multiplier to give more importance to recent data points:

- Calculate the SMA for the initial EMA value.

- Determine the weighting multiplier:

[2 / (selected time periods + 1)]. - Use the formula

EMA = (Closing price - EMA(previous day)) x multiplier + EMA(previous day)to calculate the EMA for each day.

Using Moving Averages for Trend Analysis

Understanding how to interpret moving averages is crucial for analyzing market trends, generating signals, and making informed decisions.

Identifying the Trend Direction

The simplest way to use moving averages is to identify the direction of the trend. If the price is above the moving average, the trend is considered upward, and if below, downward. The angle of the moving average line can also indicate the strength of the trend.

Trading Signals

Moving averages can also generate buy or sell signals through crossovers. A bullish signal is given when a shorter-term moving average crosses above a longer-term moving average. Conversely, a bearish signal occurs when a shorter-term moving average crosses below a longer-term moving average.

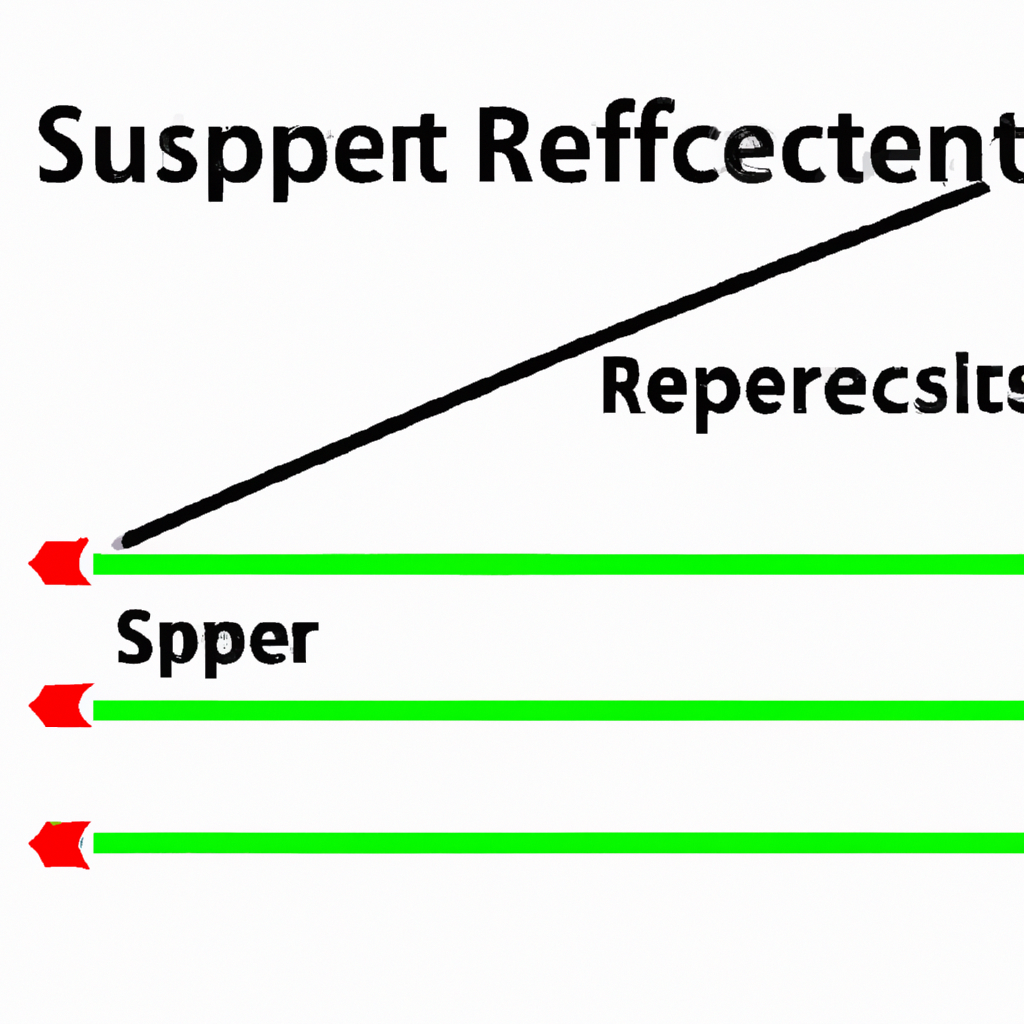

Support and Resistance

Moving averages can act as levels of support in an uptrend and resistance in a downtrend. Traders might buy when a price touches and bounces off a moving average in an uptrend or sell when a price touches and rebounds off a moving average in a downtrend.

Strategies for Using Moving Averages

Integrating moving averages into trading and investment strategies can enhance decision-making processes and improve the accuracy of forecasts.

Dual Moving Average Crossover

This strategy uses two moving averages of different lengths. A signal to buy or sell is generated based on the crossover of these averages, as mentioned earlier.

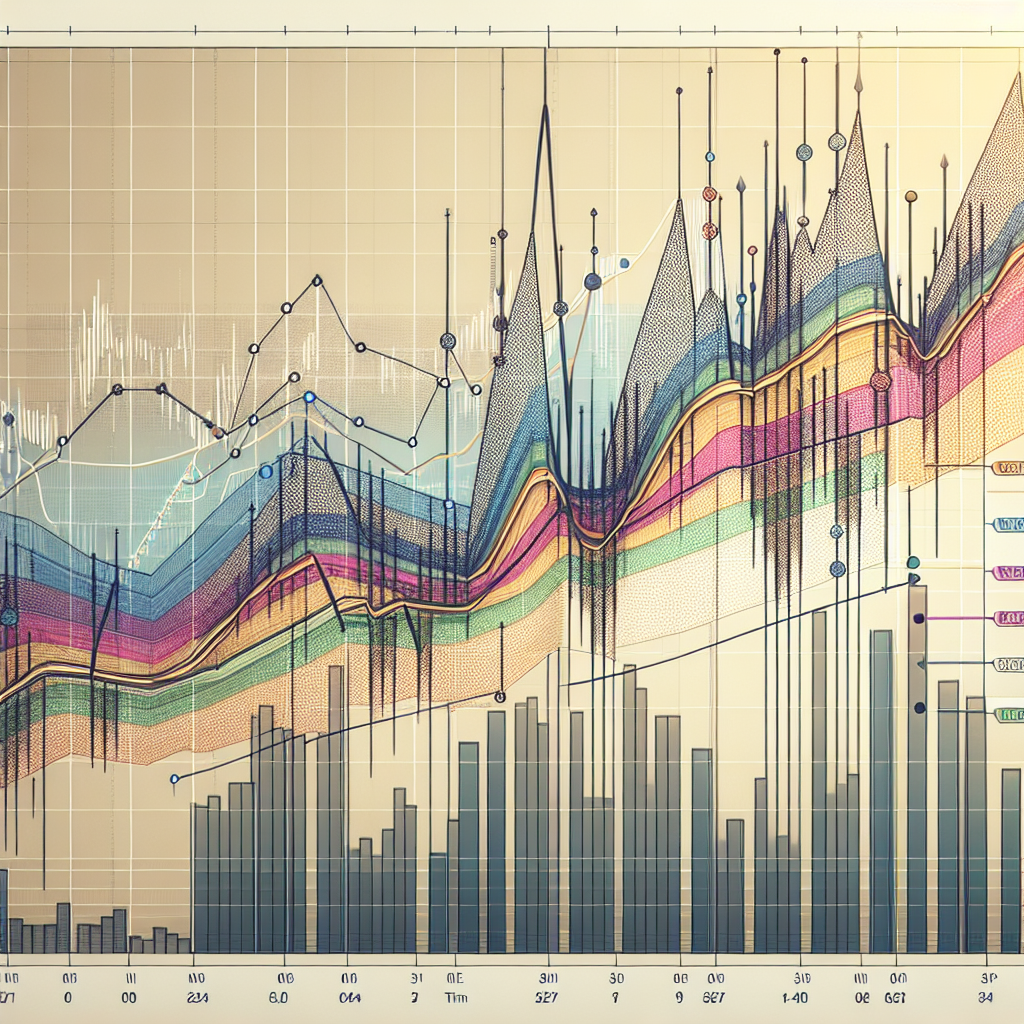

Using Multiple Moving Averages

Some traders use three or more moving averages of different periods to create a more nuanced view of the market trend and to pinpoint the timing of entry and exit points more accurately.

Combining with Other Indicators

Though powerful, moving averages are often used in conjunction with other indicators such as MACD, RSI, or Bollinger Bands for confirmation, which can help reduce the likelihood of generating false signals.

Conclusion

Moving averages are invaluable tools in trend analysis, helping to dampen the noise of short-term price fluctuations and highlight underlying trends. By understanding and effectively applying different types of moving averages, traders can improve their market analysis and decision-making skills. However, like all technical analysis tools, it is important to use them as part of a broader trading strategy and not in isolation.