# Mastering Trading with Harmonic Patterns Harmonic patterns in the trading world are a sophisticated method of technical analysis, based on the discovery that market prices trend and reverse in cycles or patterns. These patterns are identified using Fibonacci numbers and ratios to predict future movements of financial markets with…

Category: Technical Analysis

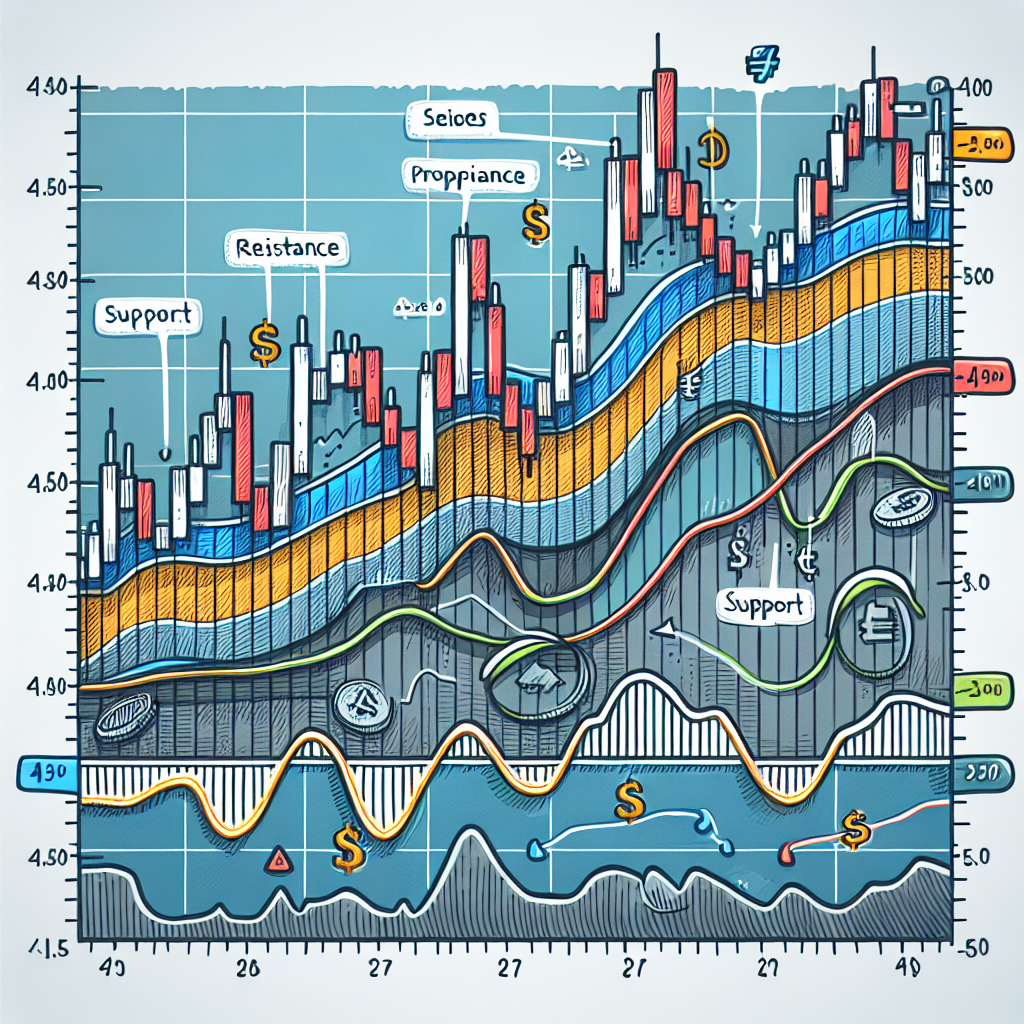

Mastering Support and Resistance in Trading

# Identifying Key Support and Resistance Zones In the world of trading and investing, understanding the dynamics of support and resistance zones is pivotal. These zones are essentially the backbone of most technical analysis strategies, providing insights into potential reversal or continuation points in market prices. This article delves deep…

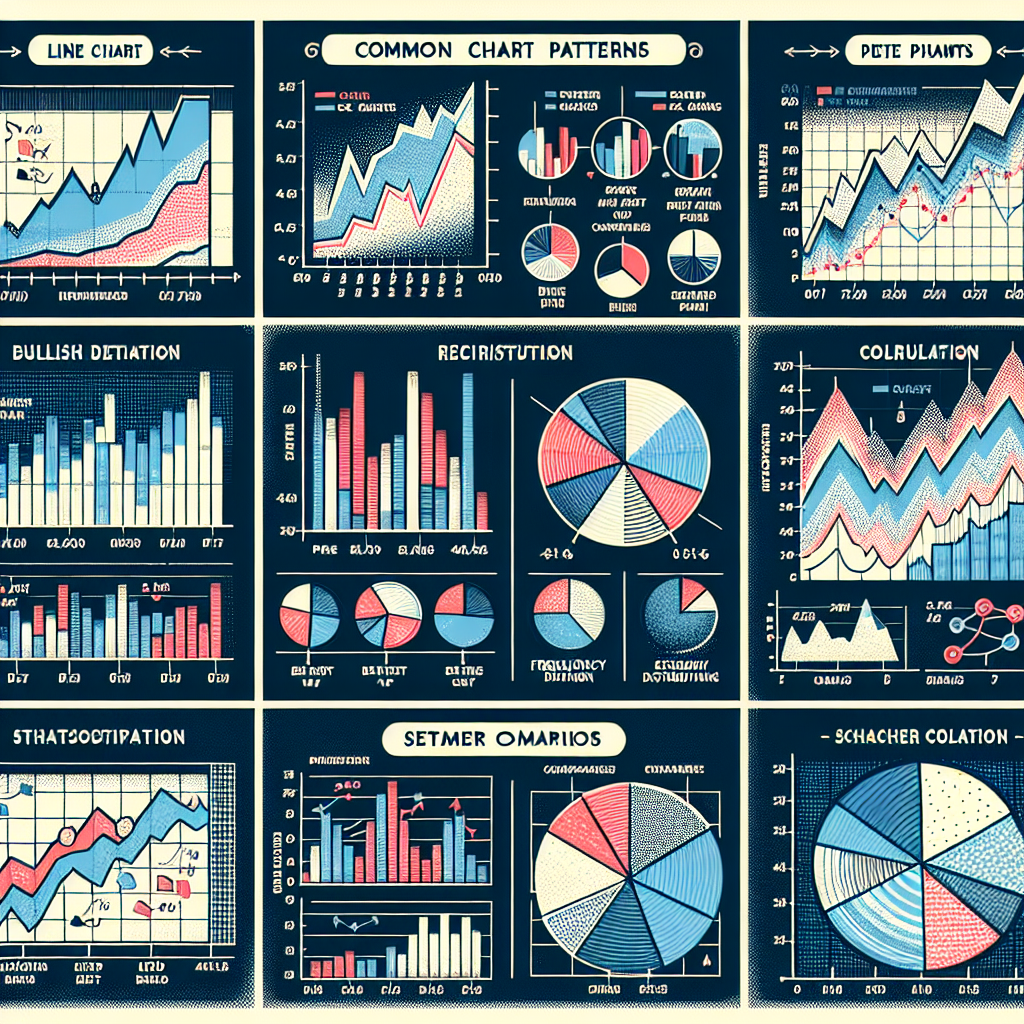

Mastering Common Chart Patterns in Trading

# Identifying Common Chart Patterns Understanding chart patterns is essential for traders and investors in the stock market, as it helps them predict future price movements based on historical trends. This article outlines several common chart patterns, offering traders insights into market psychology and potential price action. ## Introduction to…

Mastering the Art of Identifying Support Levels

Introduction to Finding Reliable Support Levels Finding reliable support levels is crucial for traders and investors looking to maximize their profits and minimize risks. Support levels, the price point at which a security tends to stop falling because of the emergence of demand, are pivotal in making informed decisions about…

Exploring Sentiment Analysis in Technical Trading

Introduction to Sentiment Analysis in Technical Trading Sentiment analysis, a key component of behavioral finance, has become an indispensable tool in technical trading. This computational study of market opinions, feelings, and attitudes towards various financial instruments or markets employs algorithms and analytical methods to parse, quantify, and apply information garnered…

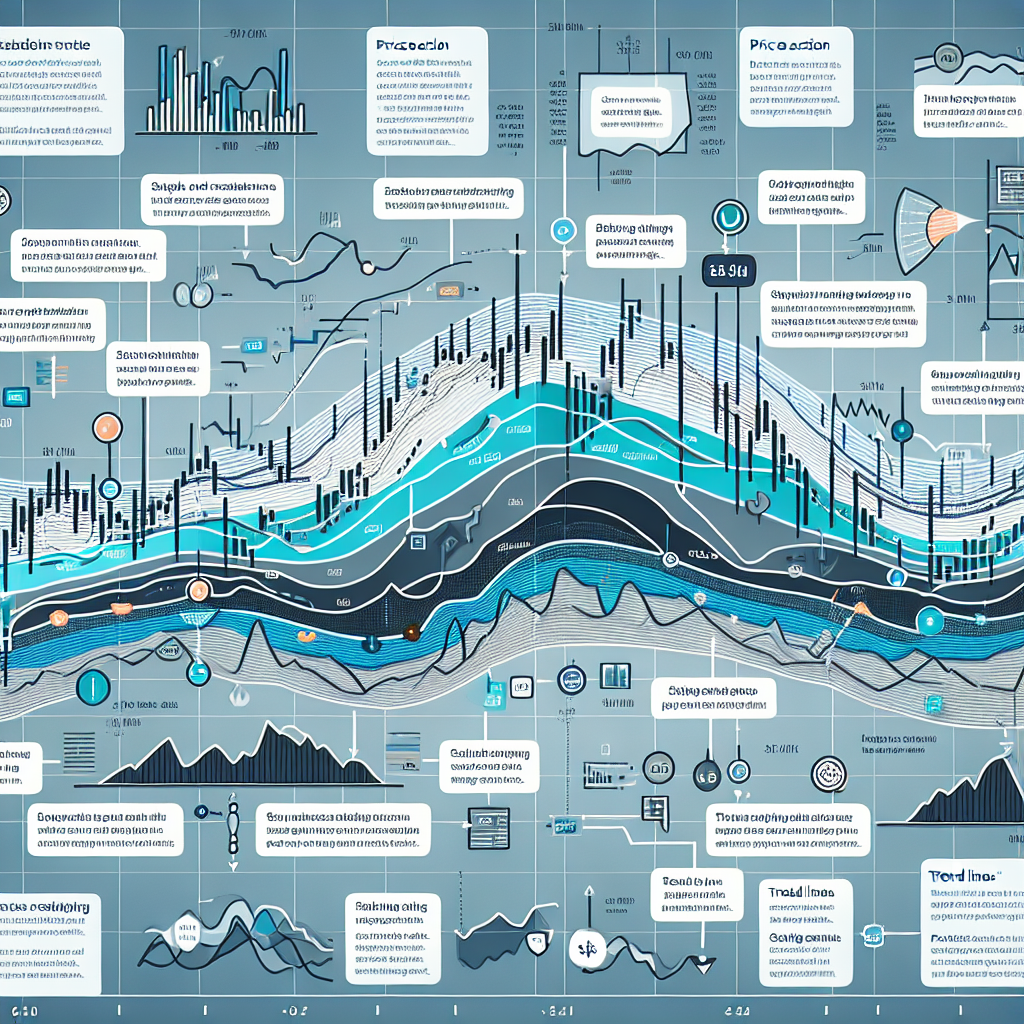

Mastering Price Action Trading: Techniques and Tips

Introduction to Price Action Trading Price action trading is a method of day trading that relies on the analysis of clean charts without the need for complex indicators. Traders use price action to interpret and make decisions based on the recent and actual price movements, rather than relying on technical…

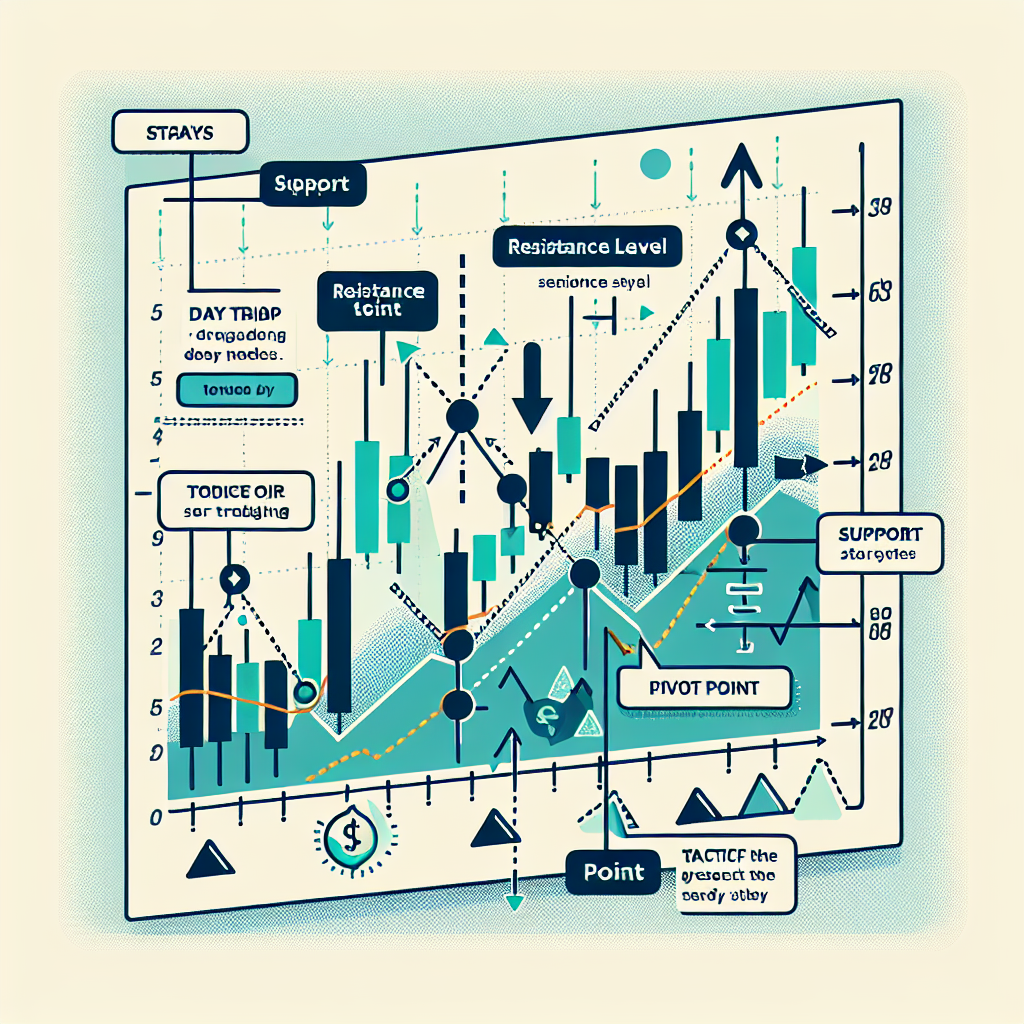

Mastering Pivot Points for Effective Day Trading

Introduction to Pivot Points in Day Trading Pivot points are widely used among day traders to determine potential support and resistance levels, essentially predicting the direction of short-term market movements. By calculating these points, traders get an insight into where the market may turn or continue on its path, providing…

Algorithmic Trading: Harnessing Technical Indicators for Profitable Strategies

Algorithmic Trading with Technical Indicators Introduction Algorithmic trading has revolutionized the financial markets, allowing traders to execute trades at lightning-fast speeds and make data-driven decisions. One of the key components of algorithmic trading is the use of technical indicators. These indicators help traders identify patterns, trends, and potential entry and…

Unveiling Volume Analysis: Techniques for Understanding Market Trends

Volume Analysis Techniques: Understanding Market Trends and Patterns Introduction Volume analysis is a powerful tool that traders and investors use to gain insights into market trends and patterns. By analyzing the volume of trading activity in a particular security or market, one can identify significant price movements, confirm trends, and…

Algorithmic Strategies: Enhancing Technical Analysis with Automation

Algorithmic Strategies in Technical Analysis Introduction Technical analysis is a popular approach used by traders and investors to forecast future price movements based on historical data. Traditionally, technical analysis involved manual interpretation of charts and patterns. However, with advancements in technology and the rise of algorithmic trading, more and more…