Introduction to Elliott Wave Analysis Methods Elliott Wave analysis is a popular technical analysis method used by traders and investors to forecast future price movements in financial markets. It is based on the theory that market prices follow repetitive patterns and can be predicted by analyzing waves of investor psychology….

Category: Technical Analysis

Using MACD Indicator for Effective Trade Signals

Using MACD for Trade Signals Introduction The Moving Average Convergence Divergence (MACD) is a popular technical analysis indicator used by traders to identify potential buy or sell signals in the financial markets. It consists of two lines, the MACD line and the signal line, and a histogram that represents the…

Using Momentum Oscillators for Trade Timing: A Guide for Traders

Momentum Oscillators for Trade Timing Introduction Momentum oscillators are technical indicators used by traders to determine the strength and speed of price movements in financial markets. These oscillators are particularly useful for identifying overbought and oversold conditions, as well as potential trend reversals. In this article, we will explore the…

Market Sentiment Analysis Tools: A Comprehensive Guide to Understanding Market Trends

Market Sentiment Analysis Tools: A Guide to Understanding Market Trends Introduction Market sentiment plays a crucial role in determining the direction of financial markets. Understanding market sentiment can help investors make informed decisions and identify potential trading opportunities. Fortunately, there are various market sentiment analysis tools available that can assist…

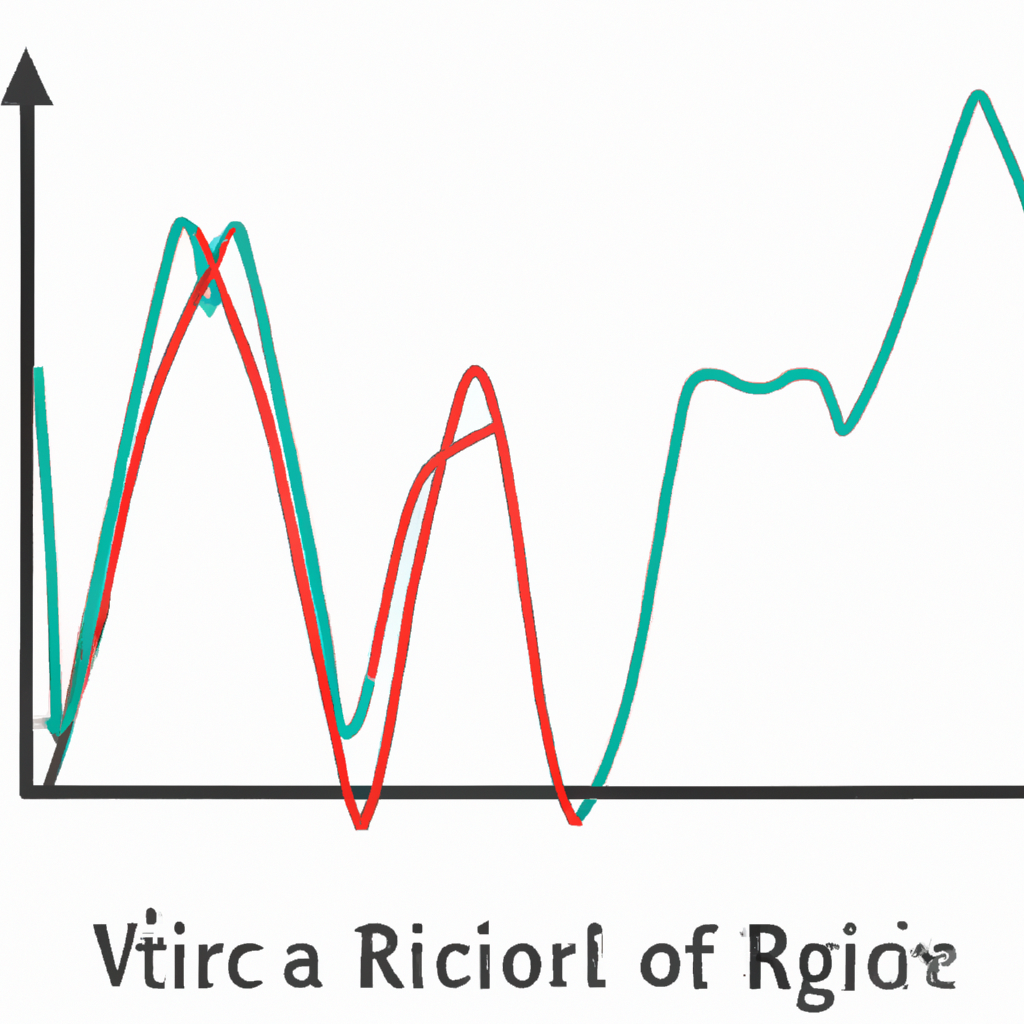

Chart Overlay Techniques: Enhancing Data Visualization

Chart Overlay Techniques: Enhancing Data Visualization Introduction In the realm of data visualization, charts play a crucial role in presenting complex information in a concise and understandable manner. However, sometimes a single chart may not be enough to convey the complete picture. This is where chart overlay techniques come into…

Algorithmic Indicators for Trading: A Comprehensive Guide to Enhancing Trading Strategies

Algorithmic Indicators for Trading: A Comprehensive Guide Introduction Algorithmic trading has revolutionized the financial markets by enabling traders to execute trades based on predefined rules and strategies. One crucial aspect of algorithmic trading is the use of algorithmic indicators, which provide valuable insights into market trends and help traders make…

Trading with Linear Regression: A Powerful Strategy for Informed Trading Decisions

Trading with Linear Regression: An Effective Strategy Introduction Linear regression is a statistical analysis technique that is widely used in various fields, including finance and trading. It involves fitting a straight line to a set of data points, allowing traders to identify trends, predict future price movements, and make informed…

Seasonal Trading Patterns: Unveiling Market Trends and Opportunities

Seasonal Trading Patterns: A Guide to Understanding Market Trends Introduction Seasonal trading patterns refer to the recurring trends and patterns observed in financial markets at specific times of the year. These patterns can be influenced by a variety of factors, including holidays, climate, economic conditions, and investor behavior. By understanding…

Understanding Volatility Analysis Methods: A Comprehensive Guide

Volatility Analysis Methods Introduction Volatility analysis is a crucial aspect of financial market analysis. It helps traders and investors understand the level of risk associated with a particular security or market. By analyzing volatility, market participants can make informed decisions about their investments and develop risk management strategies. In this…

Understanding and Utilizing the Relative Vigor Index (RVI) in Trading Strategies

Introduction to Relative Vigor Index (RVI) When it comes to technical analysis in the financial markets, traders and investors often rely on a wide range of indicators to help them make informed decisions. One such indicator is the Relative Vigor Index (RVI). Developed by John Ehlers, the RVI is a…