Understanding Event-Driven Market Analysis In the ever-evolving landscapes of finance and investment, event-driven market analysis emerges as a pivotal strategy for traders and investors aiming to capitalize on market movements triggered by specific events. This form of analysis hinges on the premise that certain events can significantly impact asset prices,…

Category: Technical Analysis

Mastering Bollinger Bands for Effective Trading Strategies

Using Bollinger Bands for Trading Trading in the financial markets can often seem like navigating through a maze of uncertainty. Yet, with the right tools and knowledge, traders can find their way to potentially profitable opportunities. One such tool that has garnered widespread acclaim among traders for its versatility and…

The Essential Guide to Backtesting Trading Strategies

# Backtesting with Historical Data: A Comprehensive Guide Backtesting is a critical step in the development and evaluation of trading strategies. By applying a trading strategy to historical data, investors and analysts can gauge the strategy’s performance and potential effectiveness in real-world conditions without risking actual capital. This article outlines…

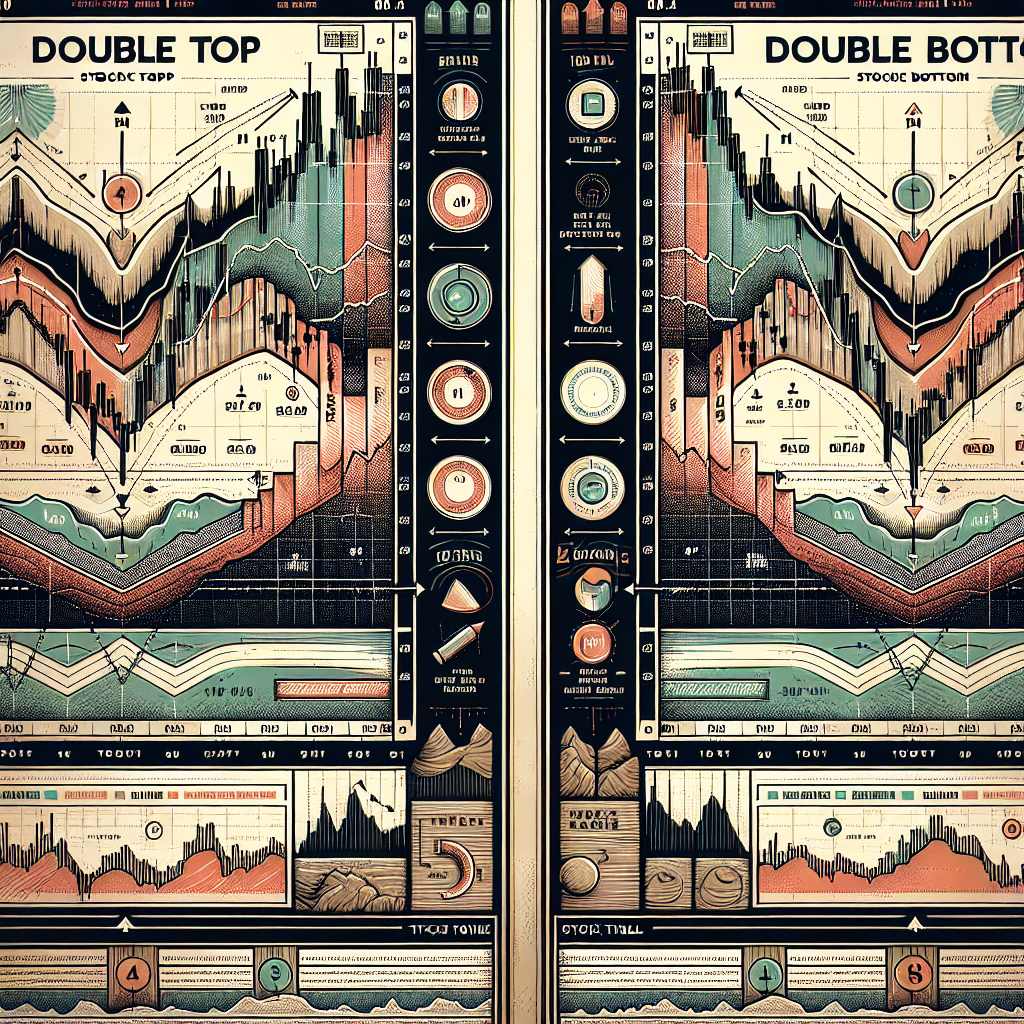

Mastering Double Tops and Bottoms in Trading

Understanding Double Tops and Bottoms Double tops and double bottoms are two of the most prevalent and reliable chart patterns used by traders to predict trend reversals. Recognizing these patterns early can be the key to successful trading strategies. Essentially, a double top indicates a potential downward shift in market…

Enhancing Trading Strategies with Divergence

Mastering Divergence in Trading Strategies Divergence in trading is a powerful tool used by traders to identify potential reversals in the market. By comparing the direction of the price action with the movement of an indicator, traders can spot signs of strength or weakness in a trend that may not…

Exploring the Applications of Fibonacci Retracement

Introduction to Fibonacci Retracement Fibonacci retracement is a popular technical analysis tool used by traders to predict future levels of support and resistance in financial markets. This method is based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move…

Mastering Cyclical Analysis for Smart Trading Decisions

Understanding Cyclical Analysis in Trading Cyclical analysis is a powerful tool in the arsenal of any trader or investor. It is based on the principle that markets and securities move in cycles, which are periodic fluctuations from an upward to a downward direction and back again. This technique relies on…

Mastering Market Timing with Oscillators

Understanding Oscillators in Market Timing Whether you’re a seasoned trader or a market novice, understanding the role of oscillators in market timing is crucial for making informed investment decisions. Oscillators are mathematical tools that predict market movements by identifying overbought or oversold conditions in financial markets. They are used alongside…

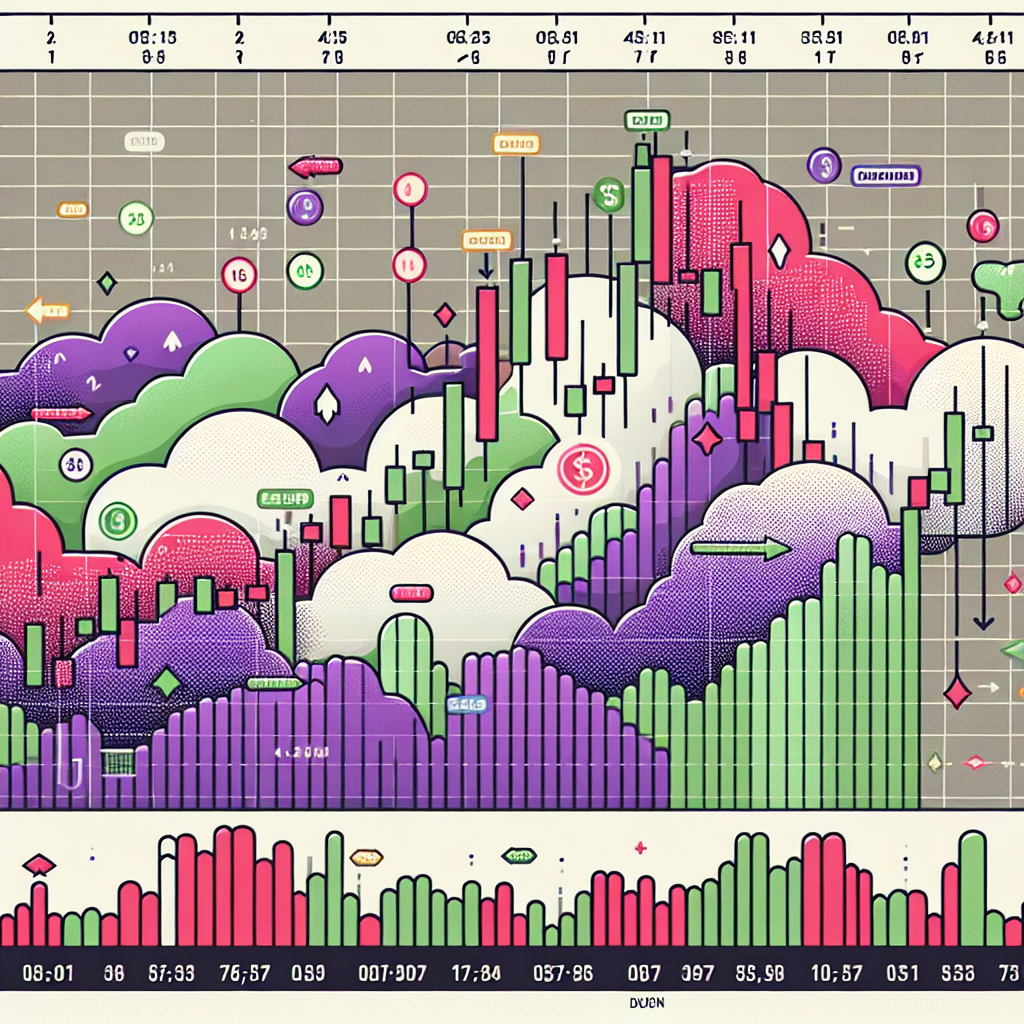

Mastering Ichimoku Cloud Trading Signals

Introduction to Ichimoku Cloud Trading Signals The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals. Originally from Japan, this strategy combines five main lines to offer a “glance” (which “Ichimoku” stands for…

Mastering Momentum Trading with Oscillators: A Guide

# Momentum Trading with Oscillators: A Comprehensive Guide Momentum trading is a strategy that uses the strength of price movements as a basis for opening trades. It’s predicated on the idea that assets that have moved significantly in one direction will continue to move in that trend for some time….