Introduction to RSI in Market Analysis

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder in 1978, RSI has become one of the most widely used technical indicators for traders and investors aiming to identify overbought or oversold conditions in the market. The indicator’s value ranges from 0 to 100, with readings above 70 indicating that an asset is becoming overbought, while readings below 30 suggest that it is becoming oversold. This fundamental knowledge serves as the base for developing advanced RSI strategies for market analysis.

Basic RSI Strategies

Using RSI for market analysis begins with understanding and applying some basic strategies. These foundational approaches enable traders to better interpret market momentum and make informed decisions.

Identifying Overbought and Oversold Levels

The most straightforward use of RSI is to identify when an asset has reached conditions that are potentially overbought (>70) or oversold (<30). This indication often suggests a possible reversal in the current trend, providing an opportunity for entry or exit.

Divergence

Divergence occurs when the price of an asset makes a new high or low that is not confirmed by the RSI. This suggests that the current price trend may be weakening, and a possible reversal could be imminent. Bullish divergence is seen when the price records a lower low, but RSI forms a higher low, indicating potential upward momentum. Conversely, bearish divergence is noted when the price achieves a new high while RSI creates a lower high, hinting at a potential downtrend.

Advanced RSI Strategies

For those looking to delve deeper into market analysis, several advanced RSI strategies can provide more nuanced insights into market dynamics.

RSI Swing Rejections

A swing rejection is a more nuanced approach to RSI analysis that looks for specific patterns in the behavior of the RSI in relation to its overbought and oversold levels. There are two main patterns of interest: the bullish swing rejection pattern and the bearish swing rejection pattern. The bullish pattern occurs when the RSI enters the oversold territory (<30), bounces above 30, pulls back without entering oversold territory again, and then breaks its prior high. The bearish swing rejection pattern is the inverse of this.

Using RSI in Trending Markets

While RSI is often used to identify potential reversals in ranging markets, it can also be adapted for use in trending markets. In a strong uptrend, the RSI may remain in overbought territory (>70) for an extended period. Instead of seeing this as a sell signal, traders can look for moments when the RSI dips below 70 as potential buying opportunities, assuming the overall trend remains strong. Conversely, in a downtrend, an RSI rise above 30 and then falling back below can serve as a signal to sell or short.

Combining RSI with Other Indicators

To increase the effectiveness of RSI strategies, many traders and analysts combine RSI readings with other technical indicators or chart patterns.

RSI and Moving Averages

A common approach is to use moving averages in conjunction with RSI. For instance, one might look for situations where the price crosses above or below a moving average while RSI provides confirmation of the trend change. This method adds a layer of validation to the signal, potentially increasing its reliability.

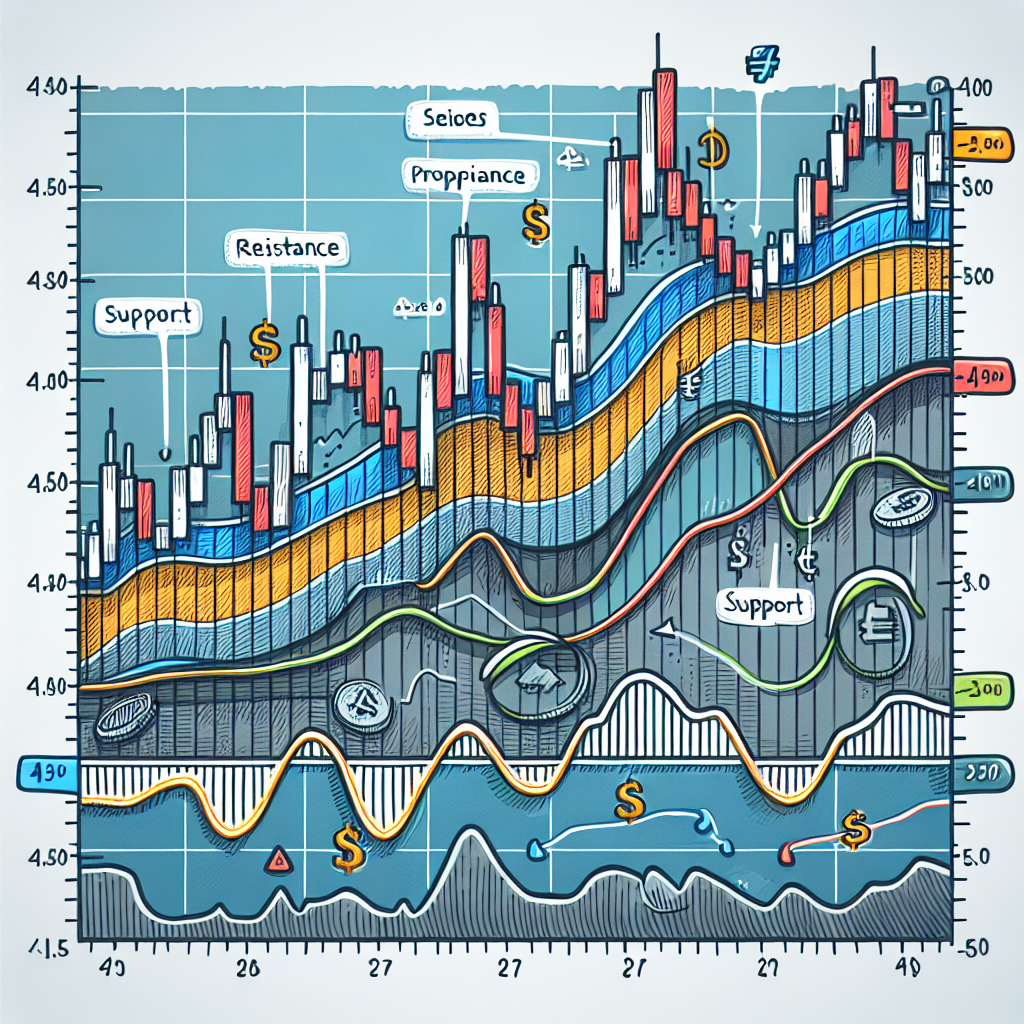

RSI and Support/Resistance Levels

Support and resistance levels provide critical insights into potential turning points in price action. When the RSI indicates overbought or oversold conditions in areas of known support or resistance, this confluence can serve as a strong signal for entry or exit. The rationale is that the psychological levels of support and resistance are likely to hold, with RSI providing an early warning signal of the reversal or continuation of the trend.

Conclusion

The Relative Strength Index is a versatile tool that, when properly understood and applied, can significantly enhance market analysis. Whether through basic strategies such as identifying overbought and oversold conditions or more advanced techniques like swing rejections and combining indicators, RSI offers traders the means to gauge market momentum with a higher degree of precision. As with any indicator, success in utilizing RSI comes from practice, experience, and continuously refining your strategy to adapt to changing market conditions.